BTC Price Prediction: Bullish Technicals and Strong Fundamentals Signal Continued Growth Potential

#BTC

- Technical Strength: Price above key moving average with improving momentum indicators supporting continued upward movement

- Institutional Adoption: U.S. Treasury strategic reserve directive and VanEck's bullish projections provide strong fundamental support

- Market Sentiment: Breaking seasonal trends and positive expert commentary create favorable conditions for sustained growth

BTC Price Prediction

Technical Analysis: BTC Shows Bullish Momentum Above Key Moving Average

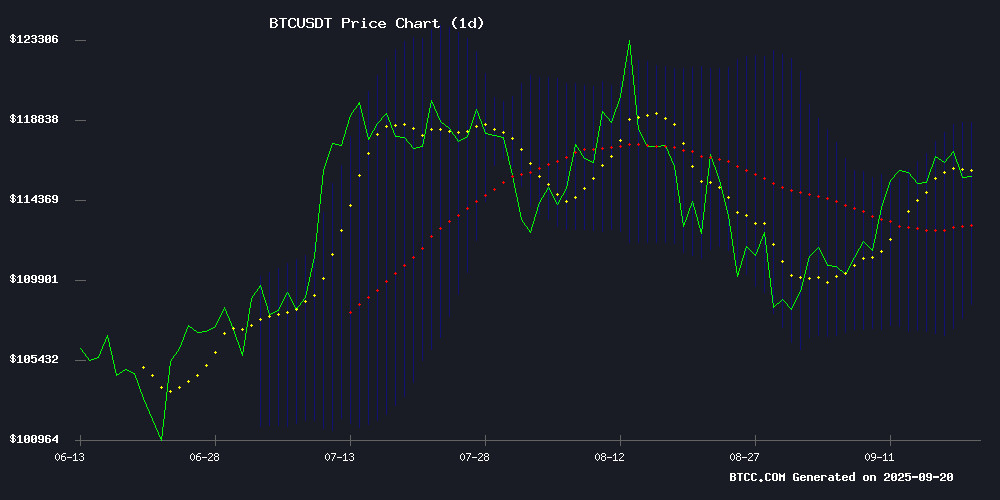

BTC is currently trading at $115,838, comfortably above its 20-day moving average of $113,615, indicating sustained bullish momentum. The MACD reading of -3,357 remains in negative territory but shows improving momentum with the histogram at -1,394. Bollinger Bands position the price between $118,706 (upper) and $108,523 (lower), suggesting potential resistance NEAR $118,700. According to BTCC financial analyst Emma, 'The technical setup favors continued upward movement, with the key support level at the 20-day MA providing a solid foundation for further gains.'

Market Sentiment: Institutional Adoption and Regulatory Support Drive Optimism

Positive news flow dominates the current market sentiment. Michael Saylor's bullish predictions about Bitcoin outperforming traditional assets indefinitely, combined with the U.S. Treasury's directive to establish a strategic Bitcoin reserve within 90 days, creates strong fundamental support. VanEck's optimistic projections and record September surge despite seasonal trends further reinforce the bullish narrative. BTCC financial analyst Emma notes, 'The convergence of institutional adoption, regulatory acceptance, and breaking seasonal patterns creates a powerful bullish case that aligns with our technical outlook.'

Factors Influencing BTC's Price

Michael Saylor Predicts Bitcoin Will Outperform S&P 500 'Forever'

MicroStrategy Executive Chairman Michael Saylor has doubled down on his bullish stance for Bitcoin, declaring it will surpass the S&P 500 indefinitely. His argument hinges on Bitcoin's fixed supply and accelerating global adoption as key drivers of value appreciation.

Saylor contends traditional indices face structural limitations, estimating the S&P 500 would depreciate 29% annually relative to Bitcoin. This stark divergence, he asserts, signals a paradigm shift where digital assets eclipse conventional investments as preferred stores of value.

The commentary surfaces as institutional interest in cryptocurrency reaches new thresholds. Bitcoin's 2024 performance—outpacing major indices by wide margins—lends credence to Saylor's thesis of digital capital superseding traditional markets.

Altcoin Season 2025 Hype Grows, But Analyst Warns It’s Not Here Yet

Market anticipation for an altcoin season is intensifying as Bitcoin's dominance wanes, yet analysts caution that the rally remains premature. The Altseason Index, a key metric for tracking altcoin performance, suggests traders are overly focused on short-term signals rather than structural market shifts.

Cas Abbé, a prominent crypto analyst, argues the monthly Altseason Index distracts from the bigger picture. "We are nowhere close to an Altseason," Abbé stated, emphasizing that the yearly index provides clearer signals. Most altcoins have yet to reclaim all-time highs—a critical threshold for confirming a sustained rally.

Bitcoin dominance hovering near 57% leaves room for altcoins to gain traction, but the decisive breakout level lies below 55%. Historical patterns suggest altcoins accelerate sharply once BTC dominance breaches this support. For now, Abbé views the dip as an accumulation opportunity: "You still have time to load up before they run."

Michael Saylor Predicts a “Digital Gold Rush” for Bitcoin

Michael Saylor, Executive Chairman of MicroStrategy, envisions Bitcoin entering a transformative phase akin to a "digital gold rush" between 2025 and 2035. Institutional adoption is dampening volatility—a sign of maturation that may disappoint thrill-seeking retail traders but underscores Bitcoin's growing legitimacy.

The coming decade will likely spawn innovative business models, corrective lessons from past failures, and unprecedented wealth generation within the crypto ecosystem. Saylor's outlook reflects institutional confidence in Bitcoin's role as a macroeconomic hedge, despite near-term price stagnation.

Michael Saylor Explains Why Bitcoin’s “Boring” Market Is Actually Bullish

Michael Saylor, MicroStrategy's co-founder, argues Bitcoin's current market stability is a precursor to significant growth. "Bitcoin is going up faster than the S&P forever," he asserts, framing it as digital capital with a projected 29% annual growth over the next two decades.

Saylor envisions Bitcoin reshaping credit markets through Bitcoin-backed digital credit—offering higher yields, longer durations, and greater safety than traditional bonds. This mechanism turns non-yielding Bitcoin into a foundation for yield-generating assets, attracting institutional capital and reinforcing the ecosystem.

U.S. Treasury Directed to Establish Strategic Bitcoin Reserve Within 90 Days

The U.S. Congress has set a 90-day deadline for the Treasury to outline plans for a Strategic Bitcoin Reserve and a federal custody framework. The FY2026 Financial Services and General Government bill, H.R. 5166, mandates a practicability report on the reserve and a technical custody plan, including balance sheet treatment and third-party custodian options.

Meanwhile, spot Bitcoin ETFs are adapting to new in-kind creation and redemption rules, reducing cash conversions and potentially altering liquidity dynamics in the spot market. As of mid-September, U.S. spot Bitcoin ETFs held approximately 1.318 million BTC.

Bitcoin Defies Seasonal Trend with Record September Surge

Bitcoin has shattered its historical September slump, posting a 7.39% gain this month—its strongest September performance since 2012. The cryptocurrency now trades at $115,662, defying its reputation as the worst-performing month with a rally that signals shifting market dynamics.

Momentum accelerated sharply on September 17th with an 8% single-day surge. Polymarket data shows traders now assign a 25% probability of BTC reaching $125,000 by month-end. The sustained buying pressure suggests robust institutional and retail interest continues to drive the market.

This breakout contradicts Bitcoin's established seasonal patterns, where September typically shows weakness. The neutral RSI reading of 55.31 leaves room for further upside potential as the asset rewrites its historical playbook.

Kevin Durant Regains Access to Bitcoin Holdings on Coinbase After Account Lockout

NBA superstar Kevin Durant has successfully recovered access to his Coinbase account following a months-long lockout, the cryptocurrency exchange confirmed. The resolution comes after Durant's business partner Rich Kleiman publicly joked about the situation during a Los Angeles conference, revealing the athlete's struggle to access his digital assets.

Durant, an early Bitcoin adopter, initially invested in 2016 when prices hovered near $600. His holdings have since appreciated over 950% as Bitcoin surged past $117,000. The account recovery highlights both the volatility of crypto security and the importance of proper access management.

Coinbase clarified the issue stemmed from user error rather than platform failure. "We worked directly with Coinbase's team," Kleiman noted, underscoring the collaborative resolution process. The incident offers a rare glimpse into the cryptocurrency challenges faced by high-profile investors.

Bitcoin Faces Potential 70% Correction Despite Bullish Projections

Bitcoin's current rally to $117,000 has sparked a sharp divide among analysts. While some anticipate a continued surge toward $250,000 by 2025, others warn of a historical pattern suggesting a 70% downturn. Benjamin Cowen of Into The Cryptoverse highlights precedent: 94%, 87%, and 77% drawdowns followed previous cycle peaks. "History cautions us to prepare for the possibility," he notes, though stops short of declaring it inevitable.

The dichotomy underscores crypto's volatility. Even Arthur Hayes' $250K prediction would still leave Bitcoin vulnerable to a retreat to $75K under Cowen's scenario. Market participants now weigh whether this cycle will defy past trends or succumb to them.

Bitcoin Nears $118K as VanEck Foresees Further Gains

Bitcoin's surge toward $118,000 has reignited global interest, positioning it within reach of unprecedented highs. This rally coincides with record-breaking performances in traditional assets like the S&P 500 and gold, fostering widespread optimism across financial markets.

Matthew Sigel, VanEck's Head of Digital Assets Research, contends Bitcoin's upward trajectory remains intact. Key metrics—moderate futures funding rates and balanced unrealized profits—suggest the market hasn't entered speculative excess. "We're not seeing the leverage spikes or profit-taking patterns that typically precede major pullbacks," Sigel noted, underscoring the rally's structural resilience.

Bitcoin ETFs and Tokenized Treasuries Drive U.S. $2.3 Trillion Crypto Growth

North America's crypto market surged to $2.3 trillion in transaction value between July 2024 and June 2025, fueled by institutional adoption and regulatory clarity. The U.S. accounted for 26% of global crypto activity, with December 2024 marking a record $244 billion in inflows. Bitcoin ETFs now hold $179.5 billion globally, while tokenized U.S. treasuries grew from $2 billion to $7 billion in assets under management.

Stablecoins dominated transactions, processing nearly $16 trillion in 2025—reinforcing dollar hegemony. Market volatility spiked in North America, with monthly growth swinging from -35% to +84%, reflecting heavy institutional participation. Chainalysis attributes the momentum to post-election policy expectations, monetary easing, and ETF inflows.

Bitcoin Q4 Outlook Shows Key Levels Supporting Bullish Run

Bitcoin is attempting to stabilize above its local range highs after recent volatility driven by the Federal Reserve’s interest rate cut. Investors are closely watching whether BTC can maintain support levels and build momentum for a promising fourth quarter.

After retesting the $117,000 resistance earlier this week, Bitcoin faced rejection but remains in the $107,000–$116,000 range that has defined its trading since late August. Early September saw a dip to local lows, but BTC has recovered steadily, signaling potential for a stronger finish to the month.

Historical trends suggest optimism. September has traditionally been a weaker month for Bitcoin, with an average negative return of 2.99% over the years. However, BTC has defied expectations over the past two years, posting gains of 3.91% in 2023 and 7.29% in 2024. This trend has raised analyst optimism for a potential green September in 2025.

Crypto analyst Jelle noted that BTC’s recent positive streak positions it for a multi-month bullish run. "If bitcoin maintains its gains for the rest of the month, Q4 looks very promising," Jelle said, pointing out that a green September often correlates with consecutive months of positive performance.

BTC’s weekly close above $114,000 has become a critical factor for traders. Analyst Rekt Capital emphasized that maintaining this level could solidify the bullish case.

Is BTC a good investment?

Based on current technical indicators and fundamental developments, BTC presents a compelling investment opportunity. The price trading above the 20-day moving average, combined with strong institutional adoption signals and regulatory support, creates a favorable risk-reward profile.

| Metric | Current Value | Signal |

|---|---|---|

| Current Price | $115,838 | Above 20-day MA |

| 20-day MA | $113,615 | Support Level |

| Bollinger Upper | $118,706 | Near-term Resistance |

| MACD Trend | Improving | Momentum Building |

BTCC financial analyst Emma emphasizes that 'The combination of technical strength and fundamental catalysts suggests BTC remains well-positioned for continued appreciation, though investors should maintain appropriate risk management given cryptocurrency volatility.'